working capital turnover ratio ideal

Working Capital Turnover Net Sales Average Working Capital. Ad Compare Top 7 Working Capital Lenders of 2022.

Working Capital Turnover Ratios Universal Cpa Review

WC dfrac 100 000 180 000 2 140 000 latex Now we can calculate the working capital turnover ratio.

. From the 20x working capital turnover ratio we can conclude that the business generates 2 in net sales for each dollar of net working. Net Working Capital Turnover Sales Net Current Assets 40000 10000 4 times The reciprocal of the ratio will become 025 that is the reciprocal of 41 is 14. This company has a working capital turnover ratio of 2.

Working Capital Turnover 190000 95000 20x. The ideal quick ratio is considered to be 11 so that the firm is able to pay off all quick assets with no liquidity problems ie. 150000 divided by 75000 2.

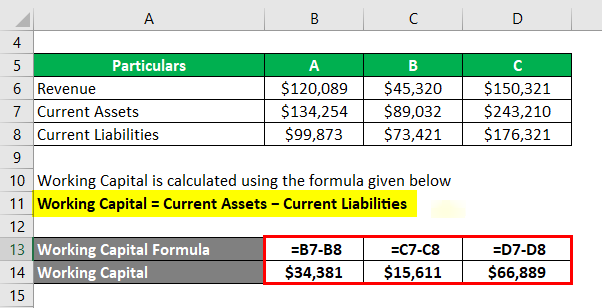

Net Sales Total Revenue - Cost of Sales Returns Allowances Discounts You then calculate the turnover ratio. Now working capital Current assets Current liabilities. Working capital is current assets minus current liabilities.

Putting the values in the formula of working capital turnover ratio we get. The working capital turnover ratio of Exide company is 214. The formula to measure the working capital turnover ratio is as follows.

A high turnover ratio indicates that management is being extremely efficient in using a firms short-term assets and liabilities to support sales. Working capital can be calculated by subtracting the current assets from the current liabilities like so. Multiply the days in a normal working week for you by 56.

This means that XYZ Companys working capital turnover ratio for the calendar year was 2. The following formula is used to measure the ratio. 100000 40000.

What your Working Capital Turnover Ratio Means. First lets calculate the average working capital. This shows that for every 1 unit of working capital employed the business generated 3 units of net sales.

While analyzing a company this ratio is compared to that of its peers andor its own historical records. It means each dollar invested in working capital has contributed 214 towards total sales revenue. Generally a working capital turnover ratio of 10 means that the company has generated sales.

Working Capital Current Assets - Current Liabilities. If the result is too high eg more than a ratio of 11 the company you are analyzing might be having trouble converting inventory to sales or not enforcing. The working capital turnover ratio measures how well a company is utilizing its working capital to support a given level of sales.

Generally a high working capital turnover ratio is better. The formula to determine the companys working capital turnover ratio is as follows. This means that for every one dollar invested in working capital the company generates 2 in sales.

Working capital Turnover ratio Net Sales Working Capital. This means that for every 1 spent on the business it is providing net sales of 7. Since we now have the two necessary inputs to calculate the working capital turnover the remaining step is to divide net sales by NWC.

To arrive at the average working capital you can sum. WC Turnover Ratio Revenue Average Working Capital. A working capital turnover ratio of 6 indicates that the company is generating 6 for every 1 of working capital.

The working capital turnover ratio denotes the ratio between a business net revenue or turnover and its working capital. 15000050000 31 or 31 or 3 Times. For example if a businesss annual turnover touches 15 lakhs and average working capital 3 lakhs the turnover ratio is 5 1500000300000.

A low ratio indicates inefficient utilization of working capital during the period. The working capital turnover ratio will be 1200000200000 6. The funds 6 turnover ratio is a fraction of the 55 to 87 turnover.

Working Capital Turnover Ratio Net SalesWorking Capital. Working capital turnover is a measurement comparing the depletion of working capital used to fund operations and purchase inventory which is then converted into sales revenue for the company. Apply Now Get Low Rates.

A ratio of 2 is typically an indicator that the company can pay its current liabilities and still maintain its day-to-day operations. 420000 60000.

Capital Structure Theory Modigliani And Miller Mm Approach Social Media Optimization Learn Accounting Accounting And Finance

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Formula Example And Interpretation

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratios Universal Cpa Review

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratio Meaning Formula Calculation

Accountancy Financial Ratio Financial Analysis Financial

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Estimation Operating Cycle Method Learn Accounting Accounting Education Accounting And Finance

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratio Different Examples With Advantages

Recapitalization Money Management Advice Learn Accounting Accounting Education

Working Capital Turnover Efinancemanagement Com

How To Calculate Working Capital Turnover Ratio Flow Capital

Activity Ratio Formula And Turnover Efficiency Metrics

Capital Turnover Definition Formula Calculation

Working Capital Estimation Operating Cycle Method Learn Accounting Accounting Education Accounting And Finance

For Full Text Article Got To Https Www Educba Com Ratio Analysis This Article Of Ratio Analysis You Will Learn Financial Ratio Trade Finance Accounting